OVRFLO CASE STUDY

Buffer Benefits

The Starting Point

Every once in a while, we get the chance to start at the ground floor with our clients. This was the case with Buffer Insurance. The owner/founder came to us with a name, a business model, and just one or two employees—the rest had yet to be built. We knew it’d be the beginning of a special relationship with their team as we started dreaming about what this brand could be.

As a fledgling company, uncovering the purpose behind the brand was essentially the same as uncovering the owner’s purpose. We had lengthy conversations about why he stepped into insurance in the first place, and how he wanted to create meaningful change for his customers and his employees.

(Van’s Kitchen brand elements before AM’s OVRFLO process)

Their Brand Before OVRFLO

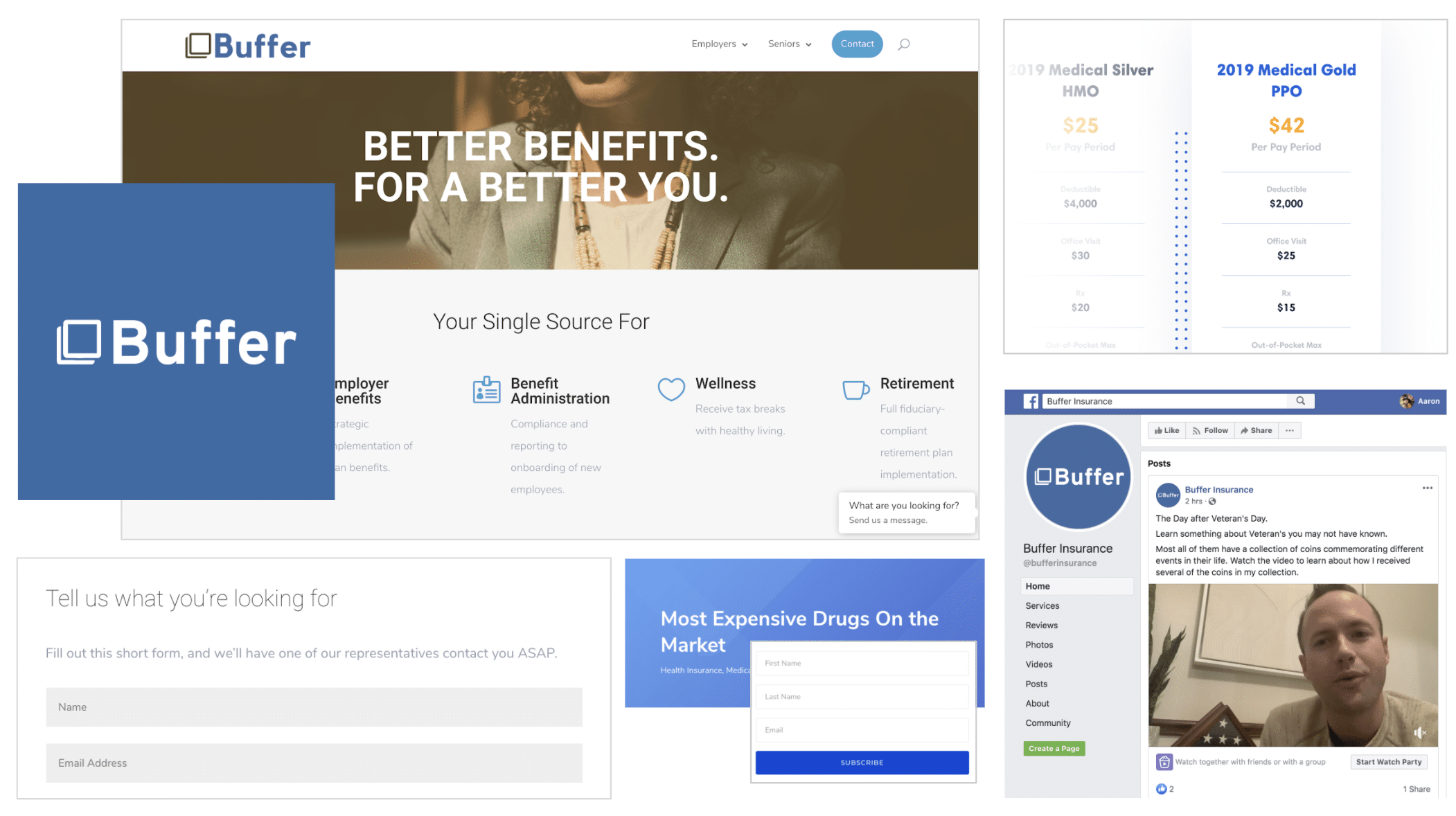

The little branding and messaging he’d done before going through our OVRFLO process wasn’t connected to a greater purpose at all; it was professional, yet sterile, and unable to connect on a deeper level.

Purpose Uncovered

The Buffer Benefits ‘WHY’:

“The most meaningful impact we make is in the lives of others. Protecting you and ensuring your future impact is our highest priority.”

We quickly found that Buffer had an advantage in insurance when it comes to messaging—most other companies are driven by shallow cost-saving or fear-driven scenarios. Buffer, however, is inspired by making an impact for others, and ensuring that impact for the future. They want to help people live their life to the fullest, without having to worry about Medicare or employee benefits. Once we had uncovered that, we knew we had what we needed to create a purpose conversation for Buffer that would attract and inspire their audiences and set them apart in the industry.

Starting with Why

After conducting an in-depth competitor analysis, we were able to hone in on a look and feel that suited Buffer’s overall brand purpose. While others had gotten close, there was no other company in the industry that had been so focused on their “why” as they developed the brand. We implemented a brand-new logo, one that was captivating and energetic, while also conveying deeper meaning to team members and customers. We applied the same process to their website, marketing collateral, and more.

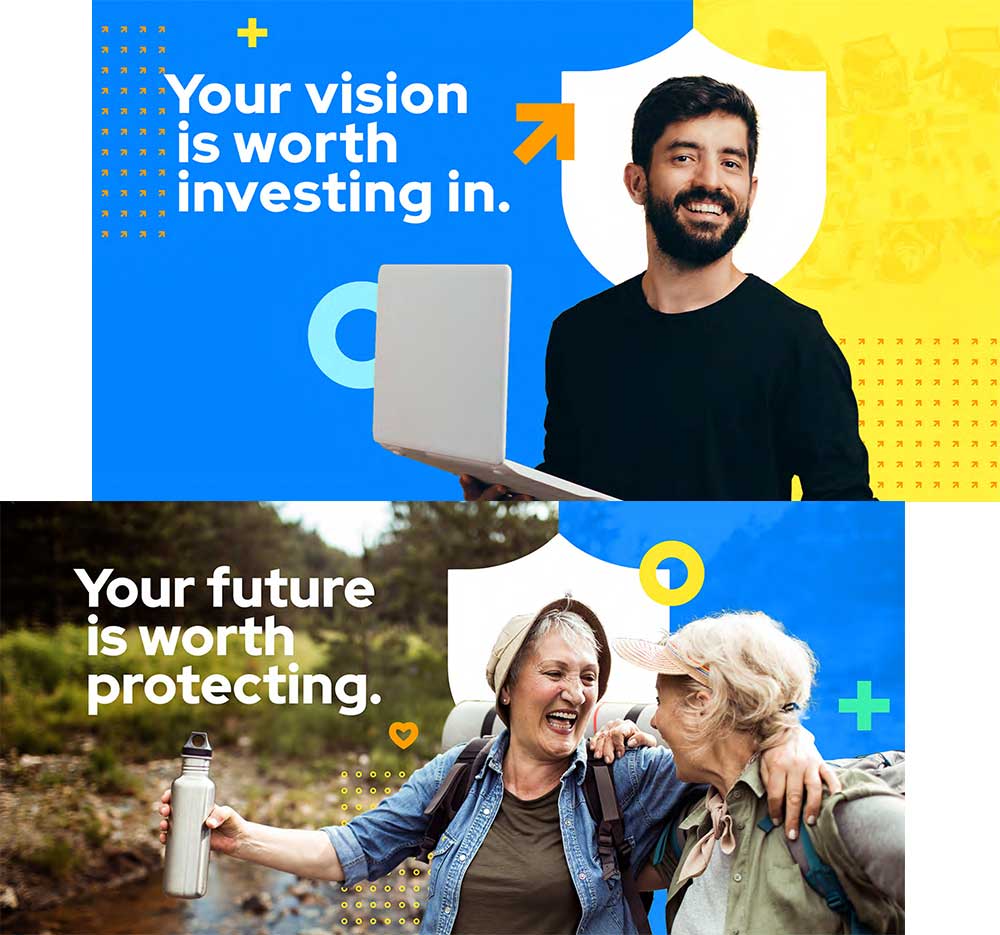

A Tale of Two Audiences

Because Buffer’s business model is unique—focusing on both Medicare customers and employee benefits—it was also key to undergo a full audience analysis as well. This is the moment when we can take a greater purpose and find a direct connection to what your customer cares about on a deeper level. For Buffer, we were able to outline the deep, emotional needs their customers have, so we could adapt their messaging appropriately.

Putting the Brand to Work

The last step in our process is about implementing all of this change into real-world strategy that will bring in customers and increase revenue. In short, Buffer was no longer an insurance company. They were now an impact company. We infused this energy and messaging into sales decks, social media, email campaigns, and event collateral. It’s a framework and perspective that still permeates through Buffer’s team, which is now up to more than 20 employees and agents, and drives every decision they make in their expanding business.

“After the overflow process, I was sitting in my car about to walk into a prospect meeting. And as I’m sitting there in my car, I’m thinking through our purpose statement and new messaging and it just felt so unnatural because I had never done that before. I had trained my mind to think about features, deductibles and copays. And so I decided that I was going to go in there and talk about our purpose. And that’s what I did. I walked in there and I start talking to this prospect about our purpose and values, and before I can even finish and get to the actual insurance and strategy part, she says, “How do we sign up? How do we get started?” I thought, oh my goodness, this actually works! It felt unnatural at the moment to say those things, but after doing it, I realized that leading with our purpose, beliefs, and values resonated with our clients, and shortened the sales process. There’s no way we’re going to go back to the old way of doing things.

AM’s OVRFLO process also helped us build a better team, because we have new employees who are being recruited and coming on board, who resonate with our belief statement from the beginning. They already believe in it because it activates something in them to believe in themselves. It’s easier for them to come on board and go in the same direction that we are. We’re not having to drag them in the direction that we’re going. It’s so much better and faster to integrate new employees now.”

Sean Turner, CEO

Buffer Insurance

Are you wanting to make the most of your big idea? Our specialty is helping businesses like Buffer, who have the drive and talent, but just need a direction to run in. We’d love to talk about how we can help you uncover your purpose and make the most of your business—whether it’s in year one or year 20.